2020-05-26 – Nasdaq 100 Index (QQQ) – Market Breadth Update

The Nasdaq 100 Index (QQQ ETF shown below) has been one of the leading indices following the March 23, 2020 low. This leadership has been accompanied by broad participation in the recent rally as our Breadth indicators on the Nasdaq 100 Index have now turned Net Bullish. We note that with 5 out of 8 of our Breadth Indicators now reside on a Bullish Trigger. Our Binary Breadth ribbon has been illustrated on the QQQ ETF below.

The breadth indicators producing a bullish trigger are provided below for reference;

- High – Low Percent (HLP);

- % Percent Stocks Above the 20-day EMA;

- % Percent Stocks Above the 50-day EMA;

- % Percent Stocks Above the 200-day EMA;

- 20-Day New High – New Low Percent;

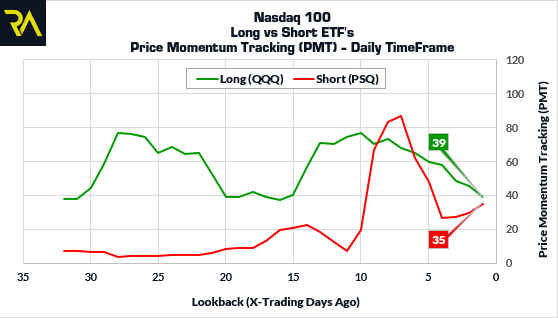

Using our Proprietary Price Momentum Tracking (PMT) indicator, we are able to detect price momentum of the Long QQQ ETF as well as it’s Inverse ETF PSQ. The screen shot below illustrates our PMT Indicator over the past 30-days;

The PMT reading of 39 for the long QQQ ETF resides above the PMT reading of 35 for the inverse PSQ ETF. Accordingly, the Bulls currently have the advantage. A re-test of February 2020 highs at 237.47 seems inevitable at this time.

Detecting a shift in the QQQ and PSQ relationship would foreshadow price weakness and profit taking in the next few weeks.

When/if this should occur, with Breadth now residing on a Bullish Posture, I’m looking to treat further price weakness as an opportunity to go long and looking north to the 127% Fibonacci Extension at 257.06 as an overhead price target as shown below;

Canadian Investors looking to participate in the Nasdaq 100 can use the ZQQ-TC ETF.

Riverside Analytics Inc (Riverside), its employees or its directors are not a registered financial advisers and do not provide investment advice or recommendations directed to any particular subscriber or in view of the particular circumstances of any particular person. Subscribers to Riverside or any other persons who buy, sell or hold securities should do so with caution and consult with a registered financial adviser before doing so. At various times, the publishers and employees of Riverside may own, buy or sell the securities discussed for purposes of investment or trading. Riverside and its publishers, owners, and agents are not liable for any losses or damages, monetary or otherwise, that result from the content of Riverside. Past results are not necessarily indicative of future performance. You are advised to discuss your specific requirements with an independent financial adviser.