2020-06-03 – TSX Financial Sector – Ready to Move?

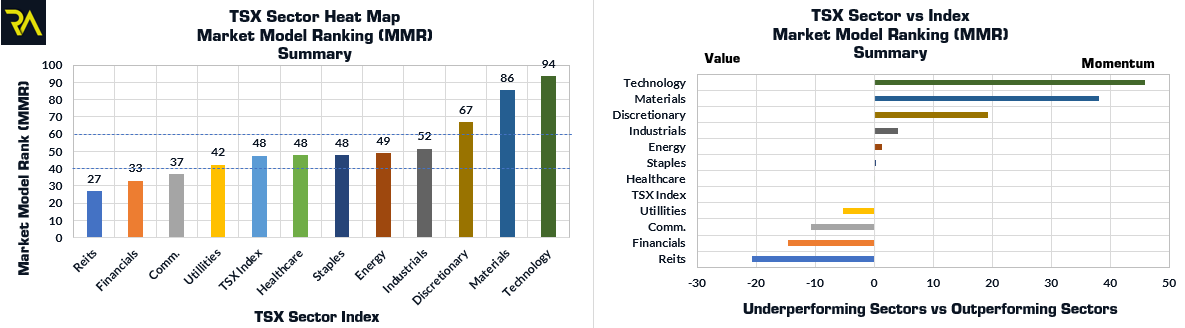

The TSX Financial Sector has been one of the weakest sectors in 2020 with a Year to Date Return of -17.9%. The weakness in the Financial Sector has been detected by our Heat Map Market Model Rankings (MMR). The image below illustrates the Financial Sector with a MMR of 33 while the TSX Index has a MMR of 48.

As the Financial Sector is lagging the TSX Index itself, we would classify Financials as being a Value Sector. Value Sectors carry the expectation that mean reversion will take place whereby allowing the sector to catch up to the Index itself over time.

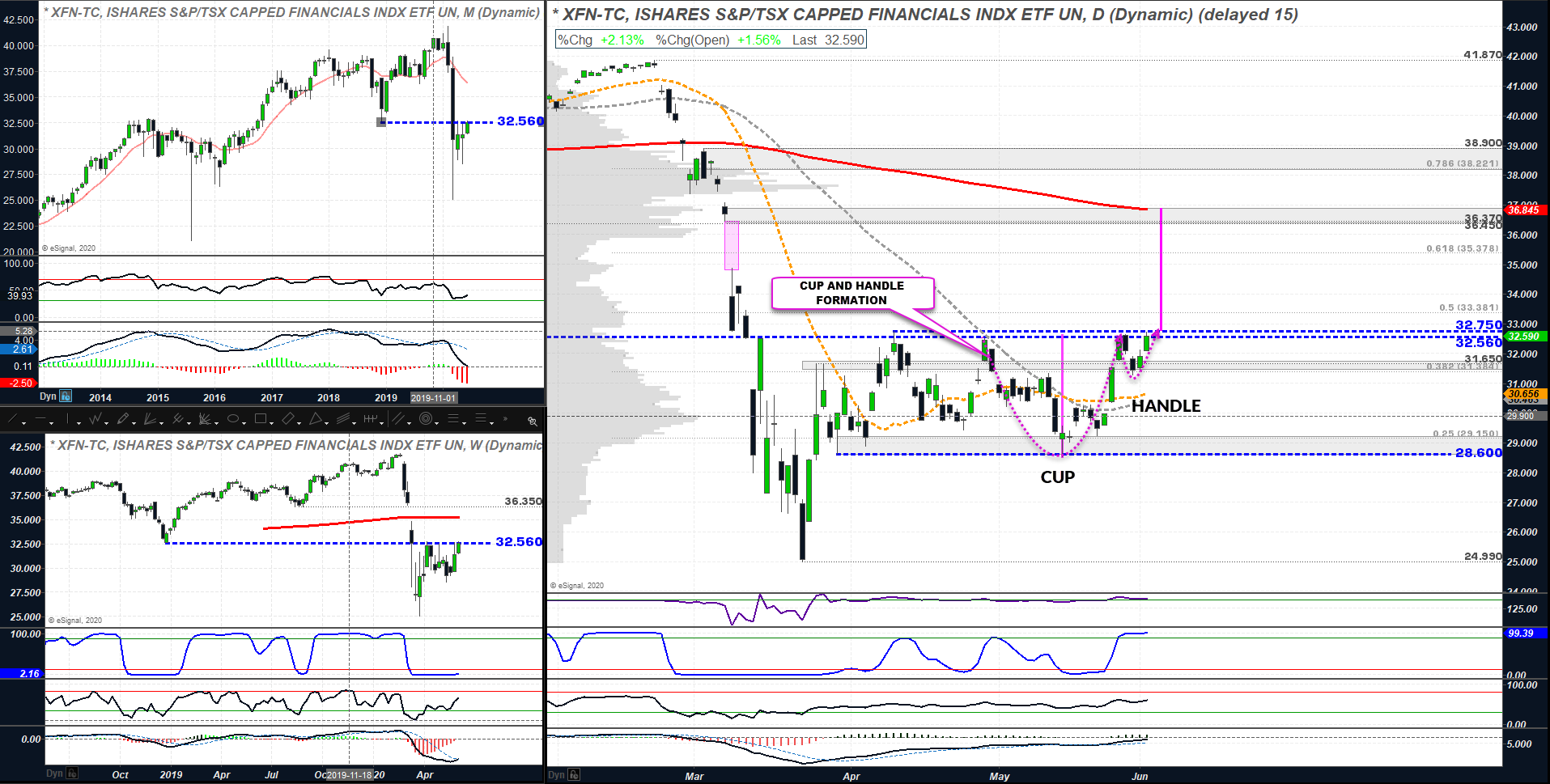

While the Financial Sector has been lagging we have been monitoring the iShares S&P/TSX Capped Financials Index ETF (XFN-TC) and it’s current chart configuration closely. The image below illustrates a triple time frame analysis on the XFN-TC ETF with a monthly chart at the top left, a weekly chart at the bottom left and a daily chart on the right.

XFN-TC has rebounded off of the March 23, 2020 lows and has been confined to a consolidation range between 32.75 and 28.60 as shown by the thick dashed blue lines on the daily chart. While inside the consolidation range, we note that a Cup and Handle formation was been taking form. This chart formation is a bullish continuation pattern. Cup and handle upside price targets are measured from the bottom of the cup (28.60) to the top of the cup(32.75) and projected above the top of the cup itself. This chart configuration would place an upside price target on XFN-TC at 36.89 or approximately 12.5% higher than current day. We note that this price target would also close the gap formed between March 6 and March 9th, 2020.

Investors looking for confirmation of further price advancement would be looking for a close above 32.75.

Riverside Analytics Inc (Riverside), its employees or its directors are not a registered financial advisers and do not provide investment advice or recommendations directed to any particular subscriber or in view of the particular circumstances of any particular person. Subscribers to Riverside or any other persons who buy, sell or hold securities should do so with caution and consult with a registered financial adviser before doing so. At various times, the publishers and employees of Riverside may own, buy or sell the securities discussed for purposes of investment or trading. Riverside and its publishers, owners, and agents are not liable for any losses or damages, monetary or otherwise, that result from the content of Riverside. Past results are not necessarily indicative of future performance. You are advised to discuss your specific requirements with an independent financial adviser.